Knowledge Center

Knowledge Center

Venezuela: Headlines, Markets, and What Actually Matters

At the outset, we wanted to share a brief personal perspective from our Chief Investment Officer and the primary author of this commentary:

With the colder-than-normal start to winter, I brought my family to St. Martin to welcome the New Year, hoping for a brief escape from the chill of Upstate New York. The trip was wonderful, right up until the morning we were scheduled to leave, when we woke to news that regional airspace had been closed following overnight developments in Venezuela. The 48 hours that followed turned into a logistical scramble as airlines, airport staff, and passengers worked through rebookings and alternative routes. We were fortunate to extend our hotel stay past our scheduled checkout, though many families were not. Crowded terminals filled quickly with travelers and luggage, and one passenger I spoke with later mentioned spending two nights sleeping on the beach. Being delayed on a Caribbean island is hardly a hardship in the grand scheme of things, but it was a sobering reminder that our travel disruptions were occurring alongside far more consequential events unfolding in a neighboring country.

A Notably Calm Market Response

While our on-the-ground reality was a logistical challenge, the reopening of financial markets was marked by a notable sense of calm. Oil prices saw only modest movement, equity indices remained relatively stable, and the typical flight to safe-haven assets was muted at best. For those accustomed to watching markets react sharply to geopolitical headlines, the subdued response might seem puzzling at first glance, but it reflects a consistent pattern in how markets process these events.

To the extent these types of geopolitical events affect U.S. equities, the impact usually comes through two primary channels: the risk of contagion, and the potential for disruption to global oil supply. On both fronts, neither currently appears to pose a meaningful threat.

The Contagion Question

Contagion risk refers to the possibility that a geopolitical event will spread, drawing in additional parties and escalating into a broader conflict. While the White House has faced some international criticism for its actions, including formal condemnation from Russia, China, and Brazil, the overall outcry has been measured rather than overwhelming. Importantly, there has been little indication that any nation is prepared to step in militarily or politically in a way that would meaningfully escalate the situation.

This stands in stark contrast to other recent geopolitical flashpoints where the risk of wider involvement created genuine uncertainty for markets. In Venezuela’s case, Nicolás Maduro was hardly a popular leader on the world stage, and a number of governments and influential leaders have either openly or subtly expressed support for his removal.

While conditions can evolve, the political calculus for most nations appears to be one of pragmatic observation rather than active intervention, which significantly reduces the risk of this situation spiraling into something far more consequential for global markets and economies.

The Oil Supply Dynamic

The second transmission channel, oil supply risk, presents an even more interesting picture. Typically, geopolitical instability in oil-producing regions threatens to disrupt existing supply, driving prices higher and creating headwinds for economic growth. Venezuela inverts that equation entirely.

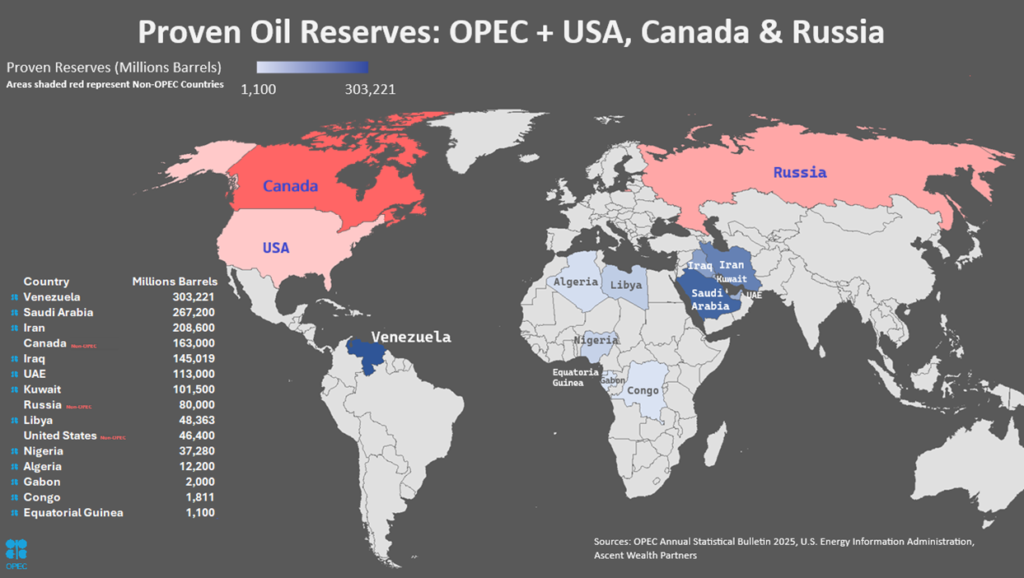

According to widely cited industry estimates, Venezuela sits atop roughly 300 billion barrels of proven crude oil reserves. That figure exceeds Saudi Arabia’s estimated 270 billion barrels and dwarfs the U.S.’s more modest 45 billion barrels. It is worth noting that these are self-reported figures, published but not independently verified by OPEC, of which Venezuela is a founding member. Because comprehensive evaluations by independent experts have never been conducted, there is some uncertainty around the actual recoverable resource base. Nonetheless, even conservative estimates place Venezuela among the world’s most oil-rich nations.

The irony is that Venezuela pumps very little of that oil, currently exporting less than 1% of global oil supply. The gap between its potential and its actual production is staggering. Output has collapsed to less than 1 million barrels per day, a far cry from the 3 million barrels produced daily during its peak in the late 1990s. Years of systematic underinvestment, political interference, and operational mismanagement gutted what was once a world-class petroleum industry. The exodus of Western oil majors following nationalizations and expropriations further accelerated the decline. Today, Chevron, the lone U.S. major still operating in the country, accounts for roughly one-third of Venezuela’s entire output.

This creates an unusual market dynamic. Rather than posing a near-term threat to oil supply, Venezuela represents a long-term source of potential additional production. If current developments lead to political stabilization and renewed investment, the result over time would be increased production entering a global market that is already well-supplied. Rather than a supply disruption that drives prices higher, Venezuela could become a meaningful source of additional barrels that could exert downward pressure on energy prices in the years ahead.

Our Perspective

Geopolitical events often feel dramatic in the moment, particularly when they intersect with everyday life. Investors have navigated a series of seemingly seismic geopolitical episodes over the past several years, from the war in Ukraine and escalating tensions in Gaza to direct confrontations with Iran and ongoing instability in Libya. In each case, early volatility faded as markets refocused on actual economic impact rather than headline drama. Venezuela appears likely to follow that same pattern.

From a purely economic standpoint, Venezuela’s current footprint is simply too small to warrant a meaningful repricing of global risk. According to the International Energy Agency, global oil supply is expected to exceed demand by 3.8 million barrels a day in 2026, which would mark a record glut. Against this backdrop, the loss or disruption of less than 1% of global production is unlikely to materially alter inflation trends, growth expectations, or corporate earnings.

For portfolios, the implications remain modest in the near term. We are resisting the temptation to overreact to developments that may prove immaterial to long-term investment outcomes. The potential upside case for increased Venezuelan oil production is real but distant, likely measured in years, not quarters. As such, our focus remains on identifying durable investment themes based on fundamental business quality, competitive positioning, and valuation rather than short-term geopolitical noise.

The airport experience in St. Martin offered a useful reminder: sometimes the most dramatic moments pass quickly, leaving behind little more than a story to tell. Over time, fundamentals tend to matter far more than headlines, and markets usually recognize that reality faster than we might expect.

As always, please do not hesitate to reach out if you would like to discuss how these or any other developments may affect your financial plan. We appreciate your continued trust and wish you a happy and healthy New Year.