Knowledge Center

Knowledge Center

Quarterly Market Newsletter – Q3 2025

The Waiting Game: Q3 2025 Market Update

Markets Catch Their Breath – and Wait for Clarity

After a year defined by trade shocks, policy pivots, and geopolitical flare-ups, the third quarter of 2025 felt more like a long exhale. The turbulence that dominated earlier in the year gave way to a calmer, more cautious tone as investors settled into a period of waiting – waiting for clarity on tariffs, for signs of a soft landing, and for the next move from the Federal Reserve.

This apparent calm, however, stems not from conviction but from collective fatigue. After months of volatility, investors now find themselves caught between hope and hesitation, less willing to make bold bets and more focused on distinguishing signal from noise.

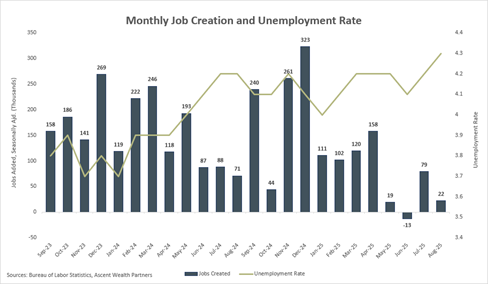

Through much of the summer, economic data painted a similarly ambiguous picture. The U.S. labor market, once a key pillar of strength, began to show clear signs of softening. Significant downward revisions to prior job growth suggested the economy was less robust than many had believed. Consumer spending held up, though with growing evidence that households are becoming more selective in their purchases. Meanwhile, business sentiment weakened, particularly among manufacturers still working through the lingering effects of earlier trade disruptions. The result is a slow-grind environment: not weak enough to signal an imminent downturn, but not nearly strong enough to inspire confidence.

Global Trade: From Stalemate to Adaptation

Trade policy once again took center stage this quarter, as U.S. tariff negotiations continued to dominate global headlines. As the extended August 1 deadline came and went, there was no breakthrough – only another extension of the ongoing negotiations. The new timeline, now stretching toward year-end, reflects a desire to maintain stability and avoid reigniting trade war headlines before the policy landscape becomes clearer.

Behind the scenes, progress has been uneven. A handful of narrow agreements have been reached, primarily with smaller partners in Southeast Asia and Latin America, centered on targeted tariff relief and renewed supply chain cooperation. Yet, the larger disputes – particularly with China and the European Union – remain unresolved. Both sides appear entrenched, and the prospect of a broad, comprehensive deal looks increasingly remote.

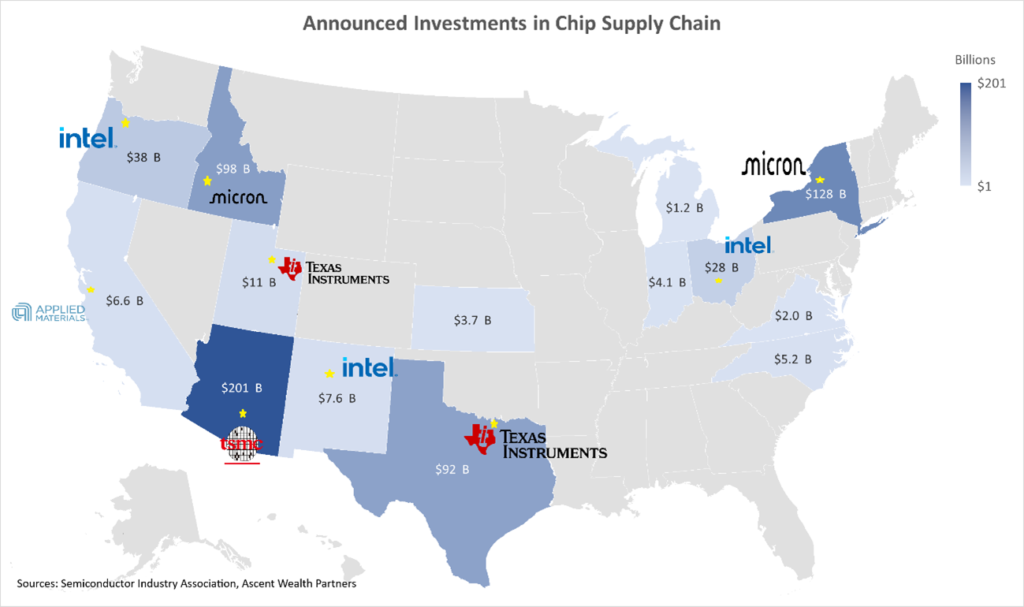

Even so, the absence of escalation has been enough to steady markets. U.S. companies have spent the past six months shifting from waiting to adapting – diversifying suppliers, reconfiguring logistics, and in some cases, accelerating plans to bring production closer to home. These adjustments are not without complexity, but they have strengthened long-term resilience. The result is a global trade environment that remains functional, though no longer as friction-free as in the past.

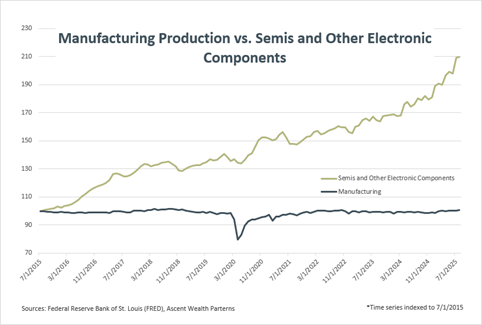

While near-term sentiment among manufacturers has softened amid uncertainty, the longer-term picture tells a different story. As supply chains move closer to home, the United States is experiencing a modest revival in domestic manufacturing and capital investment, particularly in critical industries such as semiconductors, defense production, and pharmaceuticals. The transition carries cost, but it is gradually reshaping the industrial base into one that is more resilient and self-sufficient for the years ahead.

Fed’s Policy Turns a Corner

While trade negotiations may dominate day-to-day headlines, the Federal Reserve faced a quieter but equally delicate challenge: how to support a slowing economy without losing ground in the fight against inflation. In a measured adjustment, policymakers lowered interest rates by 25 basis points this quarter – a modest step, but an important one.

Fed Chair Jerome Powell was careful to frame the move not as the start of a new easing cycle, but as a “fine tuning” adjustment in response to the softening labor market. This decision marks a turning point; after a long period focused almost exclusively on inflation, the Fed has signaled a more balanced stance, giving greater weight to its goal of sustaining economic stability. Markets largely welcomed the move, viewing it as reassurance that the Fed stands ready to cushion any slowdown if needed, while remaining vigilant on inflation risks.

Our Portfolio Moves and Outlook for the Balance of the Year

The easing of trade tensions and a more supportive policy stance have brought a measure of stability to markets, even as uncertainty lingers beneath the surface. The extreme swings that defined the first half of the year have given way to a steadier tone, though questions about growth and corporate earnings remain.

The recent government shutdown added another layer of uncertainty to an already cautious environment, though markets appeared largely unfazed. Most participants viewed it as a temporary disruption rather than a meaningful shift in the broader economic outlook.

In this environment, we have remained deliberate and opportunistic. Following a strong summer rebound, we have used market strength to trim positions that had appreciated significantly, realizing gains where valuations have become less compelling. The same process that guided us to be buyers earlier in the year during tariff-driven pullbacks is guiding us now to take profits selectively. Our approach is not about timing markets, but about staying anchored in valuation and risk management.

On the fixed income side, we have continued to extend maturities, taking advantage of elevated yields and locking them in for the longer term. This strategy has proven timely, as interest rates have eased modestly following the Fed’s rate cut.

Looking ahead, we see value in maintaining a measured stance – defensive enough to navigate ongoing volatility, yet flexible enough to seize opportunities as they arise. We have modestly raised cash in certain strategies, creating room to deploy capital should market dislocations present attractive entry points. Across portfolios, our focus remains on high-quality businesses with consistent earnings power, strong balance sheets, and durable competitive advantages.

As we enter the final stretch of the year, our message remains consistent: stay patient, stay disciplined, and stay invested with purpose. The months ahead may bring more noise, but long-term investors are rewarded not for predicting the next headline, but for maintaining conviction through it.

Thank you, as always, for your continued trust.