Knowledge Center

Knowledge Center

Quarterly Market Newsletter – Q2 2025

Q2 2025: Markets Regain Footing as Tariff Fears Recede

The first half of 2025 was a tale of two distinct quarters. What began with historic turbulence, as fears of an all-out trade war rattled global markets, gave way to a period of tense calm. A collective step back from the brink, headlined by a pause on sweeping new tariffs, provided much-needed breathing room. This de-escalation allowed markets to stage an impressive rebound and gave investors the space to shift their focus back to underlying fundamentals. Now, with the first half in the rearview mirror, attention turns from “What just happened?” to the more pressing question of “What happens next?”

The optimistic narrative on trade is that the worst may now be behind us. The administration’s decision in early April to pause tariff implementation wasn’t just a delay; it opened a crucial window for negotiation. We have seen tangible progress with some key partners like the United Kingdom, Vietnam, and China, which has unmistakably lowered the temperature on some of the most high-stakes potential trade disputes. However, in a clear sign that the situation remains highly fluid, new tariff notices detailing steep percentage hikes were recently sent to numerous other countries. Still, the subsequent extension of the negotiating deadline to August 1st suggests the administration is employing the familiar tactic of a “carrot and stick” approach: offering the prospect of a deal while simultaneously demonstrating a willingness to escalate.

This improving trade picture has allowed investors to refocus on economic fundamentals, which – at least for now – tell an encouraging story. Inflation has remained largely contained, though this stability could be tested once the full impact of the recently enacted tariffs filters through to the broader economy. Separately, consumers continue to show impressive resilience despite the dual pressures of higher interest rates and dwindling pandemic-era savings. This economic backdrop has boxed the Federal Reserve into a patient, data-dependent stance. Policymakers remain hesitant to cut rates while tariff risks linger, though they appear ready to act should the economy falter. The belief in a “Fed put” – the idea that the central bank will step in to support markets if conditions worsen – is a notable tailwind. This sense of a safety net, combined with the remarkable adaptability shown by corporate America, provides a solid foundation for the market’s continued strength.

We, however, remain more measured. While the progress on trade is certainly encouraging, the fragile calm of the second quarter feels more like a temporary truce than a lasting peace. Beyond the headline risk that trade negotiations could sour, we see elevated market valuations that leave little room for disappointment, particularly when corporate profit forecasts hinge on near-flawless execution. At the same time, we are monitoring clear signs of slowing in crucial areas like business investment and manufacturing – a slowdown that could eventually spill over into the labor market, often the last domino to fall. These domestic concerns are amplified by an unsettled global backdrop, reminding us that any number of international flare-ups could disrupt the constructive tone on trade. While many may be eager to dismiss today’s risks, we believe a disciplined focus on managing them is as important as ever.

Fiscal Policy Takes Center Stage

Over the July 4th holiday weekend, the administration signed the landmark reconciliation bill into law, cementing a major piece of its economic agenda. With the legislative process now complete, the market’s attention turns fully to the law’s real-world consequences. The package, which makes many of the tax cuts first enacted in 2017 permanent, is designed to provide a direct tailwind to the economy by leaving more capital in the hands of corporations and consumers.

A key component of the new law, especially relevant for our clients in New York, is the change to the State and Local Tax (SALT) deduction. The previous $10,000 cap has been substantially increased to $40,000 per household, with a gradual phase-out for incomes above $500,000. For many households in high-tax regions, this change translates directly into a lower federal tax burden, which could, at least in theory, provide a meaningful boost for local consumer spending and housing markets.

However, the bill’s stimulative effects are matched by concerns over its impact on the nation’s fiscal health. Independent analyses project the new law will add several trillion dollars to the national debt over the next decade, bringing the country’s long-term fiscal trajectory back into sharp focus. While not an immediate crisis, the growing debt burden is a structural headwind that will eventually need to be addressed. In the near term, this fiscal picture has direct consequences for the bond market. To finance a wider deficit, the U.S. Treasury must issue more bonds, a dynamic that puts upward pressure on government yields and, by extension, on the interest rates for everything from mortgages to corporate debt.

A New Geopolitical Reality

While domestic policy captured much of the market’s attention, the second quarter was also marked by a dramatic escalation in the Middle East. The direct military strikes by Israel against Iranian targets, followed by targeted U.S. bombing of Iran’s nuclear facilities, have thrust the region into its most precarious position in years. The market’s reaction was swift and predictable: a classic ‘risk-off’ event where investors fled to safety and oil prices moved higher on fears of a regional war that could disrupt critical energy supplies.

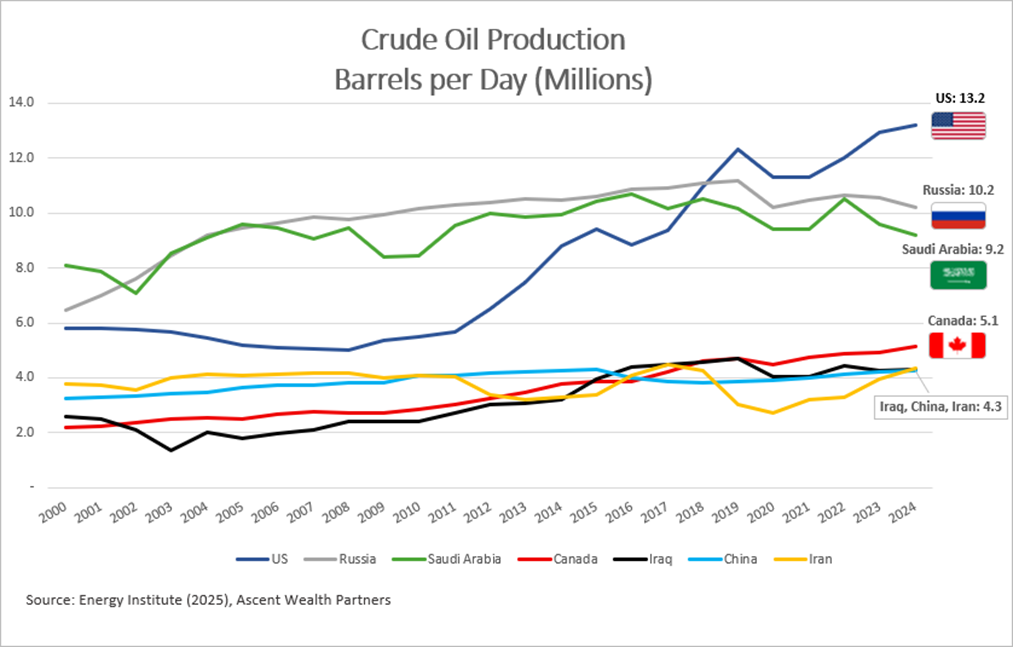

Historically, the fear of a sustained oil price shock has been the primary reason geopolitical events in the Middle East have shaken U.S. markets. This time, however, after an initial spike, oil prices have stabilized rather than spiraling out of control. This most likely reflects a fundamental shift in the global energy landscape: the emergence of the United States as the world’s largest oil producer provides a powerful buffer that did not exist during the major Middle East conflicts of the 20th century, calming the market’s worst fears about a catastrophic supply disruption.

This is not to say the risks are gone, but rather that their nature has changed. With the threat of a crippling oil shock reduced, the market’s focus has shifted to the more complex and unpredictable geopolitical fallout: whether the conflict will widen, how Iran and its allies might retaliate, and the potential impact on global trade and diplomatic relations. History shows that while markets often regain their footing after the initial shock of a crisis, the direct military involvement of the U.S. adds a layer of gravity that sets this event apart. Our strategy in such times is not to react to headlines, but to remain anchored in our long-term conviction in resilient, high-quality businesses capable of weathering these storms.

Our Portfolio Actions: Putting Our Plan to Work

Our last letter detailed the defensive steps we took heading into 2025 – trimmed positions in more vulnerable areas and built a healthy cash reserve. This “dry powder” was a key part of our strategy, designed to provide a buffer against volatility and the flexibility to act when opportunities arose. The market turmoil in the first half provided precisely the kinds of opportunities we had anticipated, allowing us to shift from a defensive posture to a period of prudent, selective offense.

During the second quarter, we began to systematically deploy our cash reserves into high-conviction companies at more attractive valuations. Our focus was not on trying to time a perfect market bottom, but on investing in quality. We concentrated on industry leaders with durable competitive advantages, robust balance sheets, and the proven ability to protect profitability during periods of economic stress. Given the shifting global landscape, we leaned further into businesses with strong domestic fundamentals and those we believe are better insulated from the complex geopolitical and trade-related risks that have emerged.

On the fixed income side, our strategy remained consistent. We continued to see value in the elevated yields available, methodically extending the duration of our bond portfolios where appropriate to lock in attractive income streams for the long term. As always, our fixed income strategy is grounded in a rigorous approach to risk management, with portfolios diversified across a range of issuers, maturity dates, and position sizes.

These actions in both stocks and bonds are a direct reflection of our core philosophy: to act with discipline and conviction when opportunities arise, rather than reacting to fear or market headlines. While there will always be uncertainty, our goal remains to build resilient, long-term portfolios capable of navigating a wide range of outcomes.

As always, thank you for your continued trust. We wish you and your family a safe and enjoyable summer!