Knowledge Center

Knowledge Center

Finding Balance: Year-End 2025 Market Review

Looking Back, Moving Forward

From Turbulence to Transition

2025 was a year of extremes. Early on, markets were rattled by renewed trade tensions, sending the S&P 500 sharply lower from its winter highs and briefly pushing the index into correction territory. Volatility surged as policy uncertainty dominated the headlines, leaving many to question whether the long-running bull market had finally met its match.

The subsequent recovery proved just as swift. A temporary pause in tariff escalation sparked one of the strongest single-day rallies in decades. By summer’s end, the index had clawed back its losses entirely, ultimately closing the year with solid gains.

The lesson was familiar, though easy to forget in the moment: markets rarely move in straight lines, and some of the most rewarding returns often follow the most uncomfortable periods.

Large-cap stocks once again carried much of the market’s advance, supported by a potent mix of artificial intelligence enthusiasm, steady corporate earnings, and an economy that continued to defy recessionary predictions. At the same time, market leadership became increasingly narrow. A small group of mega-cap companies drove a disproportionate share of index-level performance, while the majority of stocks posted more modest, though still positive, returns.

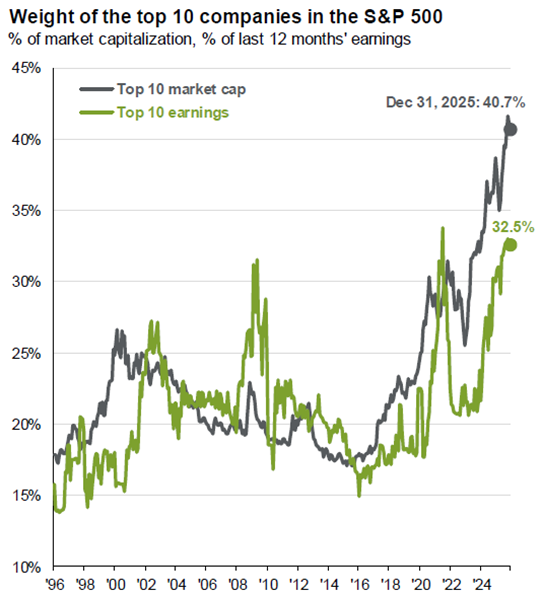

This concentration matters more than many investors realize. The S&P is often viewed as the ultimate barometer of a diversified economy. The math, however, tells a more nuanced story. While the index includes 500 of the largest U.S. companies, the top ten now account for well over 40% of its total weight. What was once a broad market benchmark has increasingly become a concentrated bet on a handful of dominant technology companies.

To be clear, we believe the long-term opportunity behind artificial intelligence is real. We are seeing tangible adoption of AI across both professional and everyday use cases, along with meaningful productivity gains. Our portfolios reflect that conviction, and we are invested in the theme, but not at the level of concentration found in the index. In our view, simply tracking a top-heavy index creates a false sense of diversification and security. When a small group of stocks carries that much influence, weakness in just a few names can overwhelm the entire index, even if most companies remain fundamentally sound.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management

This dynamic reinforces our preference for active management. Our focus remains on what we own, why we own it, and how it fits within a balanced portfolio, rather than replicating an increasingly concentrated and expensive benchmark.

The Fed’s Final Act of 2025

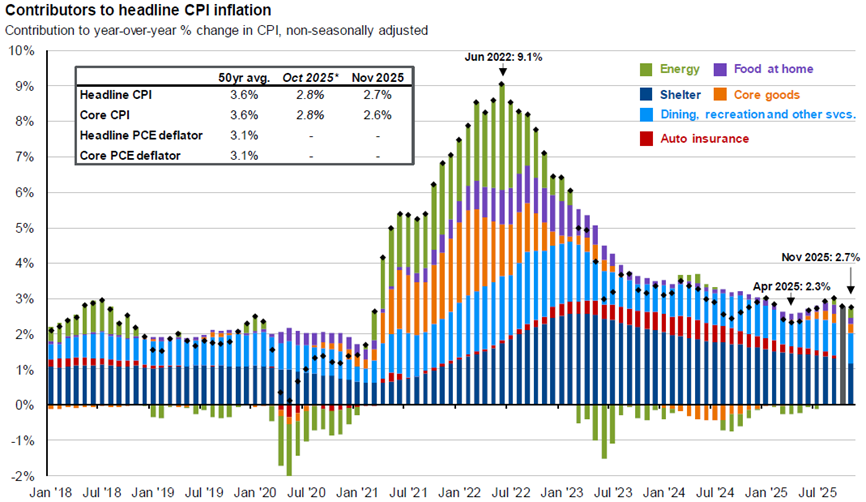

While trade headlines provided much of the drama in 2025, the most consequential shift unfolded more quietly. After more than two years of aggressive tightening, the Federal Reserve’s fight against inflation began to show the kind of progress policymakers had been aiming for. Prices stopped accelerating at the concerning pace seen throughout 2023 and 2024, and the downward trend appeared durable rather than temporary. This was particularly notable given the “tariff indigestion” we saw in the spring, when new trade policies initially threatened to push costs higher. Instead, the economy proved capable of absorbing these shifts without reigniting a broad inflationary spiral. This gave the Fed the necessary breathing room to shift its focus from fighting inflation at all costs to preserving economic stability.

Source: BLS, FactSet, J.P. Morgan Asset Management

What made this outcome notable was not just that inflation cooled, but how it cooled. The playbook from prior decades suggested the central bank could not tame inflation without breaking something. Many economists had argued that bringing prices under control would require a recession, widespread job losses, and significant economic pain. That scenario did not materialize. The labor market softened from its post-pandemic highs but did not collapse. Wage growth moderated, yet for much of the workforce it remained broadly aligned with inflation, helping preserve purchasing power and supporting demand.

This backdrop allowed the Federal Reserve to begin lowering interest rates in the second half of the year. In total, the Fed delivered three 25-basis-point reductions at its September, October, and December meetings. Chair Jerome Powell was careful to describe these moves as “fine-tuning” rather than the start of an aggressive easing cycle. This distinction mattered. After two years focused almost exclusively on inflation, the Fed adopted a more balanced posture, giving greater weight to sustaining economic stability and supporting the labor market. The pace of cuts was measured, but the shift in emphasis was significant.

Markets welcomed the pivot. Lower interest rates helped stabilize financial conditions, ease pressure on borrowing costs, and improve visibility for both consumers and businesses. Rate-sensitive areas of the economy that had struggled under nearly two years of higher financing costs began to find firmer footing.

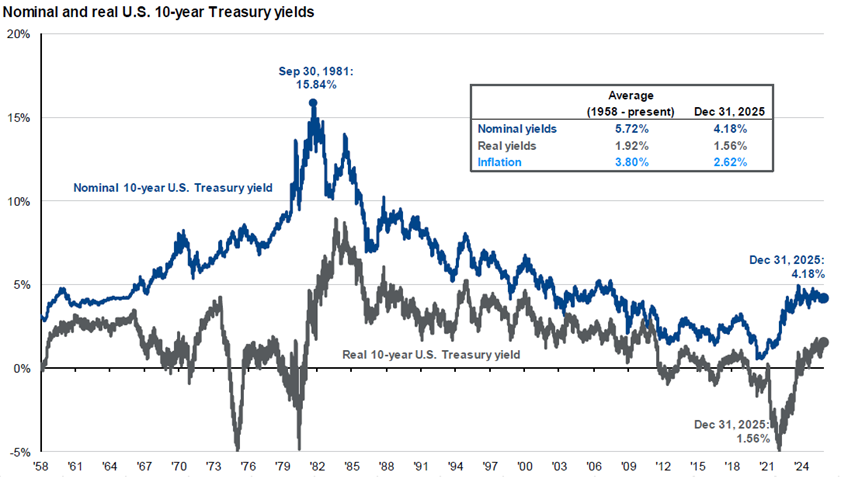

Fixed income markets responded as well. Treasury yields, which had remained elevated for much of the year, declined as rate cut expectations took hold. For bond investors, this environment presents both opportunity and nuance. Yields remain attractive relative to the past decade, offering income levels not seen since before the financial crisis, and continue to serve a constructive role in portfolio diversification.

Source: BLS, FactSet, Federal Reserve, J.P. Morgan Asset Management

Our Final Word: Navigating 2026 with Purpose

Throughout 2025, periods of volatility allowed us to put our principles into practice: facts over speculation, process over reaction, and quality over chasing performance.

During the spring selloff, when trade tensions sent markets sharply lower, we selectively added to high-quality positions that had been unduly punished. As markets recovered through the summer and fall, we took profits in areas where valuations became stretched, rebalancing portfolios to maintain appropriate risk levels.

On the fixed income side, we used the elevated yield environment to extend maturities strategically, locking in attractive rates for the longer term. This positioning has proven timely as yields have declined following the Fed’s rate cuts. The income these bonds generate provides both stability and meaningful cash flow, while their longer duration offers support should economic conditions soften more than currently anticipated.

As we move into 2026, our positioning reflects both caution and opportunity. We have modestly raised cash levels in certain strategies to preserve flexibility should volatility create attractive entry points. Our equity holdings remain focused on businesses with characteristics that tend to endure across market cycles: pricing power, high returns on invested capital, manageable debt levels, and management teams with track records of disciplined capital allocation. We maintain selective exposure to artificial intelligence without the top-heavy positioning of passive strategies. Technology remains important, but not at the expense of other sectors offering compelling risk-reward profiles.

The road ahead is unlikely to be smooth. Geopolitical tensions remain elevated (see our recently distributed email on developments surrounding Venezuela and their market implications), corporate profit margins are near historic highs and vulnerable to pressure, and the full impact of higher interest rates may not yet be fully reflected in economic data. At the same time, the U.S. economy has proven more resilient than many expected, inflation is moving in the right direction, and the Fed has demonstrated willingness to support economic stability when conditions warrant.

Our role is not to predict which of these forces will dominate, but to ensure portfolios are positioned to navigate a range of outcomes. That means avoiding extremes in positioning, maintaining genuine diversification, and staying focused on what we can control: the quality of what we own, the prices we pay, and the discipline to act with conviction through changing conditions.

Markets will continue to provide both challenges and opportunities. The year ahead will be no different. What remains constant is our commitment to thoughtful stewardship of your capital and a long-term perspective that looks beyond the noise of any single quarter or headline.

Thank you, as always, for your continued trust and confidence. We look forward to navigating the years ahead together.